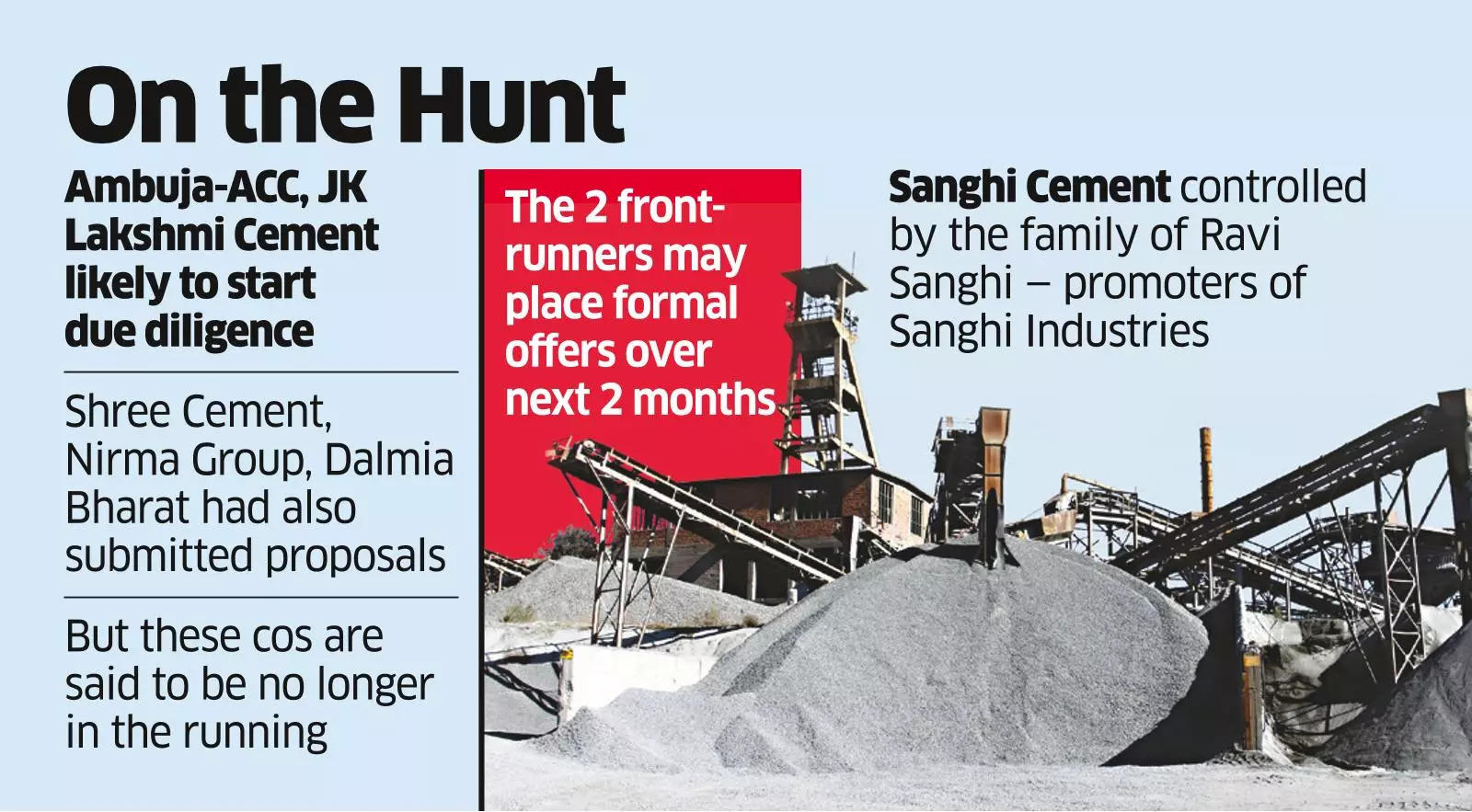

New Delhi: Ambuja-ACC owned by Adani Group and JK Lakshmi Cement Ahmedabad-based leads the race for acquisitions Sanghi Cement It is being sold for an estimated enterprise value of Rs 6,000 crore, said people familiar with the matter.

Both the lead companies are expected to start due diligence on the company soon and if it is satisfactory, make a formal offer in the next two months, he added.

Shree Cement, Nirma Group And Dalmia India It had also submitted a proposal to acquire a controlling stake in Sanghi Cement Company, but is no longer in the running, the people said.

Sanghi Cement is controlled by the family of its promoter Ravi Sanghi. Sanghi Industries,

Shares of Sanghi Industries on Monday hit a 52-week high of Rs 93.35 on the BSE, taking the company’s market capitalization to about Rs 2,400 crore. The company’s shares have gained 26% in the last one month.

“No comment on market speculation,” a Adani Group The spokesperson said in response to ET’s questions.

JK Lakshmi Cement and Sanghi Cement declined to comment. Dalmia and Nirma The group also declined to comment. Shree Cement has confirmed that it has pulled out of the race to acquire Sanghi Cement.

Ambuja-ACC, JK Lakshmi Cement and ultratech The top three cement players are in Gujarat from where Sanghi Cement derives the bulk of its revenue.

“This is a very strong strategic fit for Ambuja-ACC,” commented a person with knowledge of the transaction discussions. The Adani family had acquired Ambuja-ACC from Switzerland’s Holcim in a deal worth $10.5 billion including cost of the open offer in May last year.

ET had first reported on April 29 about the talks regarding the sale of Sanghi Cement to Shree Cement and then on June 6 about JK Group and Nirma’s interest in the company.

As per the latest available financial data for the year ending December 31, 2022, the Ambuja-ACC alliance registered consolidated sales of Rs 30,000 crore. It is the second largest cement company in India after UltraTech, owned by the Aditya Birla Group. According to a recent report by credit rating agency CRISIL, both Ambuja-ACC are debt free and have obtained only non-fund based facilities like bank guarantees and letters of credit from banks.

In a note issued on April 28, CRISIL assigned AAA rating to Ambuja Cement’s bank facilities.

JK Lakshmi Cement, which is part of the business group run by industrialist Bharat Hari Singhania, also has ambitious plans in the cement sector. It is looking to increase its cement capacity to 30 MTPA through mining license and Rajasthan has ample limestone resources that can generate enough annual limestone production to meet capacity expansion plans.

The company has a net debt-to-Ebitda ratio of less than 1, according to a recent report by credit rating agency Crisil, which has assigned AA credit rating to the company in a note dated February 1.

JK Lakshmi Cement reported a revenue of Rs 5,431 crore for the year ended March 2022.